Can Your Cash Fight Inflation?

This is a subtitle for your new post

Can your cash fight inflation?

When was the last time you were able to tell someone that you are making 7%+ on your Gov’t bond, CD, or cash sitting in your bank account? The answer was probably sometime in the late 1980’s. Since then, interest rates have been on a steady decline and have been near zero percent for the better part of a decade. This is kept your cash, treasuries, and CD’s from making anything more than what we like to joke about in the office, and that’s “12 Cents”.

But this decline in interest rates over the last 40 years has done more than make your cash less and less valuable. It is has spurred on a 40-year bull run in traditional bonds. Yes, traditional bonds have been a great low risk asset for the last 40 years, but the tides may be changing. If you’re not sure why, be on the lookout for our upcoming text on Bonds in a rising interest rate environment. SPOILER ALERT!!! Traditional bonds fall in value during a rising rate environment. Now equities have gone through the business cycle multiple times over that same period, making new highs, correcting, and making new highs again.

This continued decline in interest rates has left us to all but forget the harsh realities of real inflation. Sure, inflation has slowly crept into the picture from time to time but with a long-term inflation rate near 2-3% since the early 90’s we are getting a real dose of reality. The problem is how do we fight inflation and where do we park our money?

History says don’t panic about inflation

First, investors should also remember that sustained periods of inflation are rare in US history. There has only been one instance of inflation exceeding 5% for 10 consecutive years (1973-82). While that was a very tough period in US economic history, there have only been seven instances of consecutive years of 5% inflation in US history (and two of those were in the 1800s). While extended periods of inflation can happen, they are infrequent.

Effect of inflation on the stock market

So, while we don’t want to panic in the face of inflation, we do want to acknowledge its impacts. As we’ve seen in recent months, a sudden spike in inflation can lead to market volatility. Stock prices, and stock market returns, are largely based on expectations of companies’ future earnings. As inflation erodes the value of a dollar of earnings, it can make it difficult for the market to gauge the current value of the companies that make up market indexes. The good news is that while Fed tightening can negatively impact fixed-income investments, equities have often historically done well during these cycles.

If you are invested for long term e.g. retirement assets you’re not living off of, equities are a great place to fight inflation and continue to grow your wealth over time. Withstanding you are invested properly in your retirement accounts you should fight inflation just fine. But what about that cash sitting around earning those 12 cents. We don’t want to risk that cash in short term market swings and know that traditional bonds suffer from a rising rate environment so what do we do?

Consider I-Bonds?

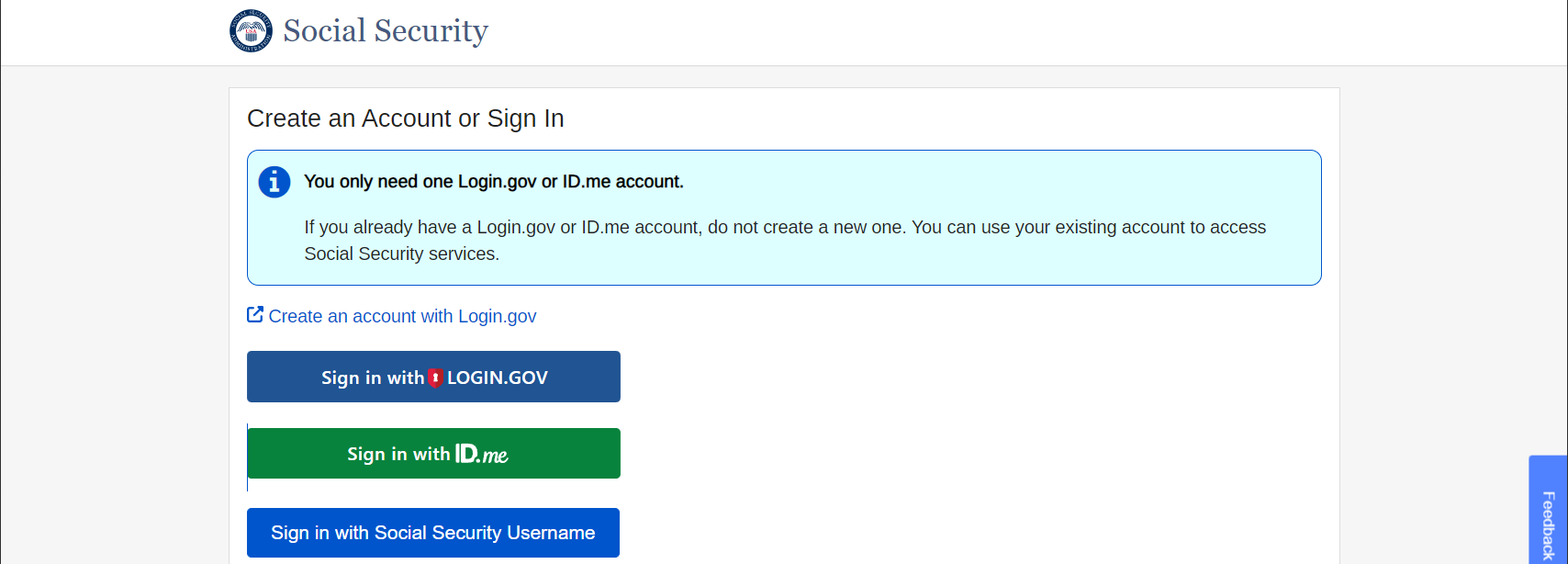

An I-Bond is an Inflation-Protected Savings Bond backed and sold by the U.S. Government. They can only be purchased directly though the government website at https://www.treasurydirect.gov/.

I-Bonds are unique in that they pay two types of interest rates:

· A fixed, 30-year interest rate (currently 0%)

· A variable semi-annually adjusted interest rate tied to inflation (currently 7.12%)

Because the second component of the interest is tied to inflation when we go through periods of higher inflation, I-Bonds help fight off the effects of that higher inflation. Currently if purchased before April 28th, 2022 you will earn 7.12% annualized return for the next six months on your I-Bond. What’s even more important is that the May 2022 I-bond inflation rate is expected to be 9.62% (based on CPI data released April 12). This combined rate comes to 8.54% over the next 12 months! At 7.12% for April purchases, and a 6-month renewal rate of 9.62%, we believe this is one of the best 12-month cash investments available. That’s a more competitive interest rate than any other “safer” account on the market—bank account, high-yield saving accounts, CDs, money market accounts, etc. Plus, I-Bonds are backed by the U.S. government, providing the “gold standard” of security for your investment.

Furthermore, they don’t carry interest rate risk like traditional bonds because there is no secondary market for them trade on. When you no longer want your I-Bond you simply redeem it through the government website, terms and restrictions do apply.

While I-Bonds benefit investors during periods of high inflation what happens when inflation tappers off and what else should I know about these bonds? Because these bonds are tied to inflation when inflation does finally taper off the yield will subside as well. This makes I-Bonds particularly attractive for the short term but may not be a long-term holding for many individuals.

I-Bonds while being a 30-year bond, only have to be held for a minimum of 12 months. After 12 months and until 5 years you may redeem your bond for a 3-month penalty. You can buy up to $10,000 worth of I-Bonds electronically each calendar year per individual (married couples can buy $20,000 total) and it must be purchased with non-qualified money.

I-Bonds have many advantages for the right investor, but they aren’t suitable for everyone. Like any investment decision, a purchase should make sense for your holistic financial plan.

Before you buy, ask yourself:

· Are you interested in I-bonds because they’ve been in the news or because they could positively impact your portfolio?

· Do you have excess cash you could put to work?

· What’s your risk tolerance and capacity?

· What is your asset allocation? Do you already have a decent percentage invested in fixed-income, or do you want more exposure?

Reach out today to see if I-bonds could be an excellent addition to your balance sheet.

Sign Up For Our Blog!

Tru Financial Strategies Blog