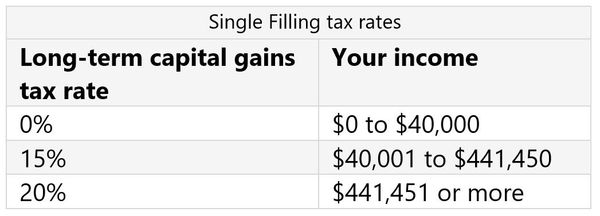

Learn How You May Pay 0% In Capital Gains Taxes

This is a subtitle for your new post

Option 1: Tax-loss Harvesting

Tax-loss harvesting is a strategic way to avoid paying capital gains taxes. It relies on the fact that money you lose on an investment can offset your capital gains on other investments. By selling unprofitable investments at a loss, you can offset the capital gains that you realized from selling the profitable ones. While this strategy can reduce your taxable income and may help get you into that 0% rate, this is a strategy that should be done with caution and attention to detail. Although, this may help justify selling a losing investment in order to get into a better option and get a tax benefit along the way. A discussion with a qualified advisor can help you determine if this strategy is right for you.

Option 2: Tax deductions

Utilizing the tax code, you may find yourself with the ability to take deductions beyond the standard deduction. This could in tern help reduce your overall taxable income, thereby reducing your capital gains tax rate.

Options 3: Hold for the long term

While this doesn’t sound like it will benefit you immediately and get you to that 0% bracket it is a worth while discussion point. Let’s say that you have stock that you have held for a long time and you never plan on selling it but instead plan on leaving it to your heirs. Did you know when you pass, your heirs get a step up in basis? This means that the cost basis when they go to sell the investment is the cost basis on the day of your death. Any gains you experienced from the time you personally bought it until that point have essentially been washed away, leaving your heirs with a near 0% tax liability. That being said it is never a good idea to hold an investment beyond its useful lifetime just to save a few tax dollars. Opportunity cost could be a much higher price.

So what if none of this helps? What if you have done everything you can to reduce your taxable income and you still find yourself well outside the boundaries of the zero percent zone. Is there anything you can do?

Option 4: Advanced planning and opportunity zones

The Qualified Opportunity Zone Program (“QOZ Program”), created by the Tax Cuts and Jobs Act of 2017, is a tax-incentive program designed to encourage long-term private sector investments in designated communities known as Qualified Opportunity Zones by delivering certain tax benefits to investors through investment vehicles called Qualified Opportunity Funds.

- Qualified Opportunity Zones are designated census tracts throughout the United States that have been selected by state governors for inclusion in the program.

- Qualified Opportunity Funds are investment vehicles that invest at least 90% of their assets in qualified businesses or real property located within these Qualified Opportunity Zones.

- Taxpayers with capital gains from the sale of a prior investment may invest those gains within a 180-day period in a Qualified Opportunity Fund and achieve potential tax benefits. (Temporary extensions and exceptions for 2020 may apply)

- Investments in Qualified Opportunity Funds are intended to help drive real estate development, job creation and overall economic growth in lower income communities.

QOZ’s help reduce your capital gains taxes in a few phases.

Phase 1: Deferring capital gains – Any investment that has a realized capital gain can have the gain portion of the investment put in a QOZ fund. By putting the gain in a QOZ fund the taxes owed on that investment become deferred.

Phase 2: Reducing taxable gain – Any QOZ fund made before December 31st 2021 and held until December 31, 2026 will have the taxable capital gain amount reduced through a 10% step-up in basis.

Phase 3: Elimination of taxable gain – Any capital gains taxes on the appreciation of your investment in the Qualified Opportunity Fund if held at least 10 years will be eliminated.

In short here is a how the QOZ fund would work. Let’s say that you had XYZ stock that you have owned for the last 20 years and recently have considered liquidating it but you are afraid to sell it for fear of capital gains taxes. Let’s say that your cost basis is $100k but the present value is $500k. Traditionally if you sold it you would owe capital gains taxes on $400k and at a 20% tax rate Uncle Sam would get $80k. By placing the $400k in a QOZ fund the taxable amount on the $400k would be deferred into the future. If held for 5 years the taxable amount on the $400k would be reduced by 10%, effectively being taxed on only 90% of the gain. If held for 10 years in the QOZ fund the taxable amount would be eliminated. Assuming an average rate of return for this asset class of 7% your $400k in taxable gains would become $786,860 all tax free.

Bottom Line: There are many ways to reduce your capital gains taxes but for some getting to 0% capital gains traditionally is not an option. For those individuals you may want to consider advanced planning techniques like the QOZ fund concept. For those of you on the border, a discussion with qualified advisor may help you use some of the techniques written about here today to reduce your overall tax liability.

Sign Up For Our Blog!

Tru Financial Strategies Blog

Investment Adviser Representative of and investment advisory services offered through Royal Fund Management, LLC an SEC Registered Investment Adviser. ARE-7433 20250 - 2020/7/13

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.

Investment Adviser Representative of and investment advisory services offered through Royal Fund Management, LLC an SEC Registered Investment Adviser. ARE-7433 20250 - 2020/7/13

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.