Should you use alternative investments as part of your portfolio?

This is a subtitle for your new post

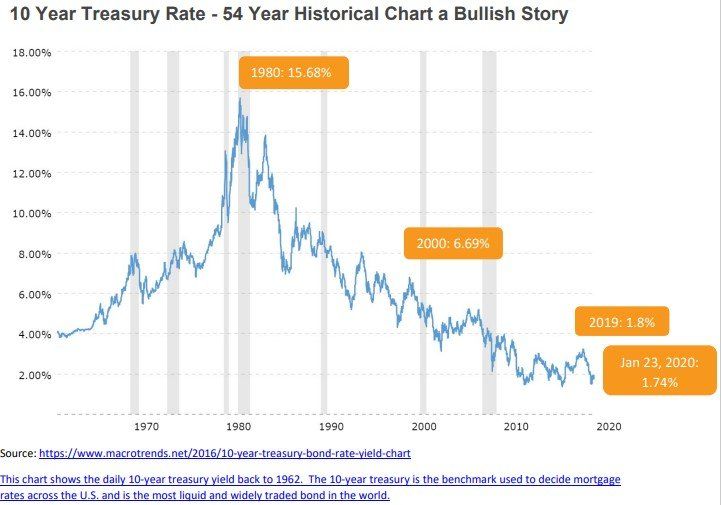

As you can see from this chart, bonds are producing historically low yields. While bonds will return principal and interest if held to maturity, during their lifetime they gain or lose value as interest rates change. More on interest rate risk later. Bond funds rarely hold bonds to maturity, which means you could lose some or all of your initial investment if you hold bond funds vs actual bonds. Over the last 40 years, bonds have gained value as interest rates declined. But what about the future? With rates hovering below 2%, are interest rates likely to stay flat, or go up (long term) rather than continuing to fall further?

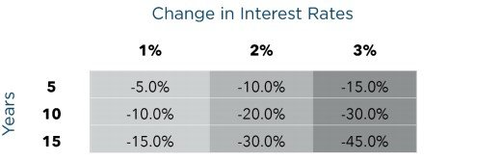

How do interest rate changes affect bond prices?

Interest rates and bond prices have an inverse relationship. When interest rates rise, prices of bonds fall. The chart below gives an eye-opening look at how to quantify changes in bond prices. As can be seen from the chart, there are two major factors that impact bond price on the secondary market. Duration is critical because longer durations increase the impact of interest rate changes on bond value. For a 10- year bond, a one percentage point increase will reduce the value by 10%. In other words, default is not the only risk you could face.

Alternative assets may be a good bond replacement

Let’s talk about what alternative investments are, what they can do, and the types you may want to consider.

What Is an Alternative Asset?

An alternative investment is a financial asset that does not fall into one of the traditional investment categories. Traditional categories include stocks (Stock funds etc.), bonds (Bond funds etc.), and cash (Money Market etc.) Alternative investments typically have a low correlation with those of standard asset classes. This low correlation means they often move counter—or the opposite—to the stock and bond markets. This feature makes them a suitable tool for portfolio diversification. Alternative assets may also provide an effective hedge against inflation, which hurts the purchasing power of paper money. Often a versatile investment category that can accomplish a myriad of goals.

What can Alternative Assets do?

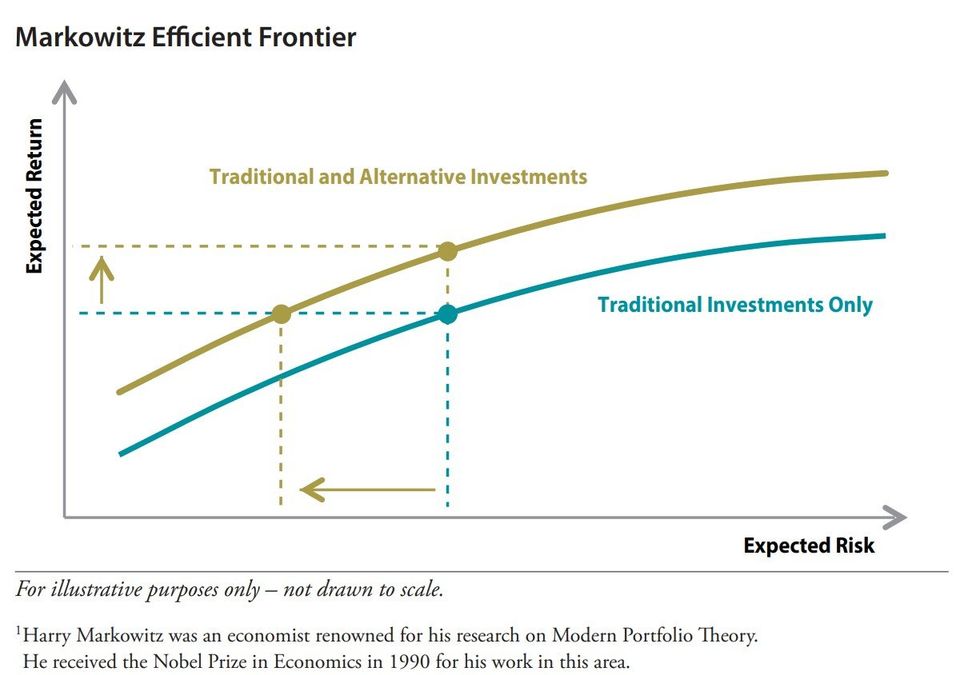

One of the many benefits of alternative assets is to add asset diversification to the overall portfolio. That asset diversification can serve multiple benefits. 1. It may lower portfolio volatility/risk. 2. It may enhance overall returns. 3. Help protect capital during periods of market declines. Harry Markowitz, renowned for his research on modern portfolio theory, taught us that traditional investments often increase your return as you increase your risk as noted by the chart below. This is how stocks and bonds typically work. The goal of an alternative asset is to shift the curve.

By using alternative assets, you may be able to continue getting the same expected return while reducing your risk. Likewise, you may increase your overall return without increasing your risk. Nearly any mixture of pure stocks and bonds will just simply slide you along the original curve i.e. less risk=less reward. Another feature of alternative assets is that they often provide more income. This is especially helpful to those that plan on living off their retirement savings. The more income they can get from their investments the less capital required to achieve your retirement income goals.

Types of Alternative assets and their individual pro/cons.

Gold: The first thing most people think of when they think of alternative assets is precious metals like Gold and Silver. The major use for precious metals by most people is to provide a hedge against inflation and asset protection. While precious metals can be a good alternative, they are not without their downsides. Although Gold (GLD) is up some 22% YTD, it is just now reaching its previous highs set in 2011 after a 40% decline from 2011-2015. So, this strategy is really a very long-term approach. Often longer than most clients are willing to stick with it. Physical metals can be difficult to value, they are Illiquid, unregulated, and even harder to sell. Additionally, because of the correlation to currencies, which then correlates through interest rates, inflation and then back to gold it can fail to act as expected. This all makes it difficult to recommend.

Real Estate: Real estate is one of those assets that has made many people very wealthy in our country and destroyed just as many livelihoods. Its an asset class that can be both very powerful and very harmful. The danger lies there in with lack of liquidity and leverage, meaning borrowing money to buy real estate as an investment. That same leverage is what can create wealth making it a double edge sward. Real estate is a very diverse asset class because of the different use cases, strategies, and financial structure. It can be a complex asset class that you will want to consider carefully. For retirees one of the main benefits is not wealth creation, but income creation and tax advantages. There are many ways to get into real estate that can provide a very nice cashflow during retirement and do it tax efficiently. Here at Tru Financial strategies we can show you how to use this asset to conservatively create additional retirement income.

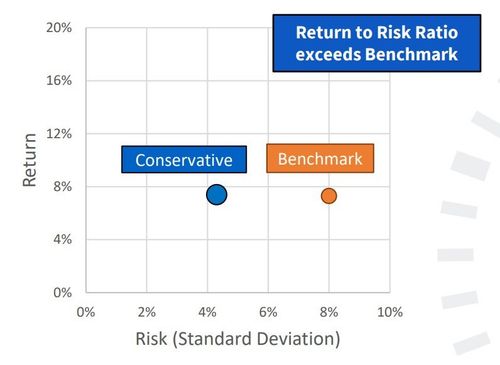

Options: Often thought of as speculative investments like gambling, options sometimes get a bad reputation. Did you know that even Warren Buffet, the stock guru uses options as a way to conservatively create income in his portfolio? In fact, here at Tru Financial Strategies with our strategic Partnership with both Royal Fund Management and ZEGA Financial, we use options not to gamble on the markets, but as a risk reduction tool or a conservative income tool. Options do have their downsides as well which in some cases include leverage and loss of principle. So, what makes options the way we use them so different? According to Jay Pestrichelli at ZEGA Financial, we use options as a different type of “monthly income” solution. It is a true alternative asset that takes advantage of the natural time decay of short-term options. It creates supplemental income without exposure to rising interest rates. We can use a proprietary model that trades positions with a high probability (>95%) of success. In fact, in the chart here you can see the risk/reward profile of our “conservative” strategy. As a reference, the S&P 500 typically has a standard deviation of 15 and a return of 10%, making our strategy much less volatile while giving up very little long-term return. Options are highly liquid and a properly constructed portfolio brings accessibility to your investments.

Annuities: Lastly but not least is a very mis-understood asset class. Annuities have been around for hundreds of years and have changed dramatically in the last 20-25 years. The old annuities where you give all your money to an insurance company in exchange for a monthly paycheck only to never see the lump sum of that money ever again is few and far between. Here at Tru Financial, we never really see a case for that type of account. So, what make an annuity a viable alternative asset class.

A fixed alternative with less risk

A fixed indexed annuity (FIA), issued by an insurance company, is a contract between you and the insurance company. An FIA can offer an innovative alternative to bonds. They provide tax deferred growth and in addition, any fixed interest earned or interest rate based on the growth of an external index, are locked in at the end of each crediting period. This means any interest or indexed interest and premiums paid cannot be lost if the market declines.

In a fixed indexed annuity, you are not directly invested in the market, but you could benefit from crediting tied to the positive movement of an index, referred to as indexed interest, with upside potential subject to certain limitations, such as a cap, participation rate, spread, or some combination of these.

Cap: A cap is the maximum rate of interest that the contract can earn in a specified period (typically a month or a year). The amount you receive would not exceed the cap rate.

Participation Rate: A participation rate is the percentage of the index increase you would receive.

Spread: Some fixed indexed annuities also calculate your indexed interest by first deducting a percentage from any increase the index achieves in a specified period.

Lastly, penalty free withdrawals are common contractual guarantees in fixed indexed annuities that permit access to a portion of the account value each year that could be used to pay for ordinary household bills. This replaces the need to potentially liquidate bonds at a discount in a rising interest rate environment.

Most fixed indexed annuities also offer the option to add an income rider, often for a fee, which produces a guaranteed predictable income stream that is not dependent on the performance of the market, and that you, and in some cases your spouse, cannot outlive. Whereas, within bond funds, income payments could fluctuate and are not guaranteed.

The take away

As you can see, alternative assets can potentially reduce volatility, provide better cashflow, add diversification, and enhance returns depending on how you use them in your portfolio. This is clear; the traditional stock/bond model is losing traction fast and with interest rates at historic lows, alternatives, specifically to bonds, need to be discussed.

If you have found this article helpful and would like to know if alternative assets should be added to your portfolio, feel free to schedule a 15-Minute discussion with us.

Sign Up For Our Blog!

Tru Financial Strategies Blog

Investment Adviser Representative of and investment advisory services offered through Royal Fund Management, LLC an SEC Registered Investment Adviser. ARE-7433 20250 - 2020/7/13

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.

Investment Adviser Representative of and investment advisory services offered through Royal Fund Management, LLC an SEC Registered Investment Adviser. ARE-7433 20250 - 2020/7/13

Licensed Insurance Professional. We are an independent financial services firm helping individuals create retirement strategies using a variety of investment and insurance products to custom suit their needs and objectives. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice.

Investing involves risk, including the loss of principal. No Investment strategy can guarantee a profit or protect against loss in a period of declining values. Any references to protection benefits or lifetime income generally refer to fixed insurance products, never securities or investment products. Insurance and annuity products are backed by the financial strength and claims-paying ability of the issuing insurance company.